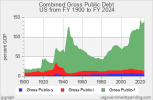

From your own link if you look at the sub link they give it gives you a much better understanding of the total debt..

1941 US debt per GDP was at 122%.

http://www.usgovernmentspending.com/us_national_debt

In your link I could not find how the definition of a household ( how many people and what ages ? ).. This can skew the numbers greatly.. ( so link please as I am working and can't keep searching )..

Many could have incomes that do not get reported such as those who work illegally, under the table and I'm not sure in the US but if your on disability in Canada or on Workman's Compensation its not taxable.

That being said these people still pay municipal taxes, state taxes and other taxes that everyday life brings upon us one way or another. If they rent a place and the landlord pays it and when they buy stuff they pay the goods taxes. I'm I correct, Yes or No ?

Your tax system and our while different probably share some in common

We have income tax

Payroll tax...The employer pays this for each workers and isnt far behind income tax.

Social security.

Medicaid tax.

State tax.

Local city taxes

Property taxes

Death taxes

Corp taxes

Various fees.

Added taxes on phone bills etc

Fuel tax.

The list is endless...and supplies the govt with large revenues....as any time there is movement they get a slice.

Govt spending is a little more than govt revenues...as some of it we borrow.

No matter how you want to slice it govt spending here comes to more that 50 grand a year per household.....when we take the spending total divided by the households.

If you want to do spending per person as you may not trust the per household

We have about 310 million people

So 6.1 trillion divided by 310 million people comes to

19677 dollars that the the govt {fed state and local} spends per citizen.

Just say 20 grand and climbing....pretty large.

Last edited by a moderator: