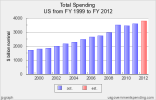

I did some calculations from this table:

http://www.skymachines.com/US-National-Debt-Per-Capita-Percent-of-GDP-and-by-Presidental-Term.htm

Total debt increased just short of $9.2 trillion 2001-2011. That's debt, meaning the spending over and beyond revenue. $1.2 trillion (being the most optimistic figure your source could come up with) can take a big bite out of the debt, but holy fuck, Tim, that still leave $8+ trillion and counting.

And you don't think we have excessive spending??

Please read my posts before stating such.

My position has ALWAYS been that we need to reduce spending while adjusting how taxes are paid in this country.

The debt problems we are facing is in large part because of the Bush tax cuts. It's not only the amount of spending.

Reducing the spending to Pre-Bush will not fix the problem, you would also need to put the tax rates to what they were.

Our current debt wasn't created by excessive spending, it was created because revenue was lowered while spending was increased. So you need to adjust both revenue and spending to fix the problem.

I always here that you CAN'T tax your way out of the problem... well you can't cut your way out either. You must have a combination.

I believe and have always believed that we have massive waste in the federal government. I would love to see meaningful cuts and reductions to manageable levels. Where these cuts take place and how we do it would not be the same as where you think we should cut, but there would be plenty of overlap.

And as far as taxes. I do not think we should just go to pre-Bush levels. It's a lot more complicated than that and I would love to see a major simplification of taxes.

My starting point would be a very simple tax code... something like this, but with numbers that are thouroughly vetted and proven to be the correct rates.

$0 - $10,000 = 0% tax

$10,001 - $40,000 = 8% tax

$40,001 - $100,000 = 12% tax

$100,001 - $250,000 = 15% tax

$250,001 - $500,000 = 18% tax

$500,001 - $1,000,000 = 20% tax

Above $1,000,000 = 30% tax

with the above rates there are zero reductions or write offs. All income is taxed the same, even if it's capital gains. Income is income is income...

Again, my numbers above are off the top of my head and I am NOT qualified to determine if they are the right rates. These numbers would need to be very carefully looked at and adjusted accordingly.

Come tax time, all one need to do is look at their income for the year and determine the amount of tax owed. That's it