You sound EXACTLY like TM. :24: Dumbass.

You will notice after awhile we all sound alike John..as so far you are the only one who has condoned a 94 percent tax

You sound EXACTLY like TM. :24: Dumbass.

Johnny seems good at using his potty mouth and calling people stupid and posting cartoons. Not once has John answered the questions.

I would like to remark about the big house that he is whining about that low level pizza delivery boys can't afford. Don't stay low skill, get off your dead ass go to college or refrigeration school or ANYTHING then maybe they could afford a nice house. Or bitch and join a Pizza boy union and ask for 50 bucks an hour then wonder why people can't afford pizza and you are jobless and living on the street.

The definition of a troll ....Yes....nail on the head.Johnny seems good at using his potty mouth and calling people stupid and posting cartoons. Not once has John answered the questions.

Johnny seems good at using his potty mouth and calling people stupid and posting cartoons. Not once has John answered the questions.

I would like to remark about the big house that he is whining about that low level pizza delivery boys can't afford. Don't stay low skill, get off your dead ass go to college or refrigeration school or ANYTHING then maybe they could afford a nice house. Or bitch and join a Pizza boy union and ask for 50 bucks an hour then wonder why people can't afford pizza and you are jobless and living on the street.

Or bitch and join a Pizza boy union and ask for 50 bucks an hour then wonder why people can't afford pizza and you are jobless and living on the street.

He is digging now....I have been using them against him ...So I suspect he will go pretty radical..he has tried Henry ford on us, Regan ...even some 1950s posters.I feel another cartoon coming that has nothing to do with being a response

Johnny got caught using his own crap and now he is in a pig sty 6' deep with no way out

Henry Ford was also aNazi sympathizer: http://www.traces.org/henryford.html

Like being pivot boy dont you TimWow, I've been missing out on one hell of a big right wing circle jerk.

Like being pivot boy dont you Tim

Sorry, don't know what that means...

but if that was an invitation to join in on your circle jerk, no thanks.

Question.

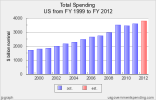

Why when bush created all this excessive spending...... bad.

Obama excessive spending and more than bush....not bad.

If we reduced spending to Pre bush {as we should}..then there is no need to raise taxes.

The debt problems we are facing is in large part because of the Bush tax cuts. It's not only the amount of spending.

Reducing the spending to Pre-Bush will not fix the problem, you would also need to put the tax rates to what they were.

Our current debt wasn't created by excessive spending, it was created because revenue was lowered while spending was increased. So you need to adjust both revenue and spending to fix the problem.

I always here that you CAN'T tax your way out of the problem... well you can't cut your way out either. You must have a combination.

We use essential cookies to make this site work, and optional cookies to enhance your experience.