In October 2005, three Citigroup analysts released a report describing the pattern of growth in the U.S. economy. To really understand the future of the economy and the stock market, they wrote, you first needed to recognize that there was “no such animal as the U.S. consumer,” and that concepts such as “average” consumer debt and “average” consumer spending were highly misleading.

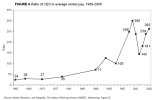

In fact, they said, America was composed of two distinct groups: the rich and the rest. And for the purposes of investment decisions, the second group didn’t matter; tracking its spending habits or worrying over its savings rate was a waste of time. All the action in the American economy was at the top: the richest 1 percent of households earned as much each year as the bottom 60 percent put together; they possessed as much wealth as the bottom 90 percent; and with each passing year, a greater share of the nation’s treasure was flowing through their hands and into their pockets. It was this segment of the population, almost exclusively, that held the key to future growth and future returns. The analysts, Ajay Kapur, Niall Macleod, and Narendra Singh, had coined a term for this state of affairs: plutonomy.