You really enjoy pulling things out of context, don't you? First you suggest that the progressive tax code is okay because the rich can pay a higher percentage of their income without suffering, then you claim that my response is supporting that they pay an even lower percentage! What about the same percentage? Ever thought of that?

You just don't enjoy seeing your economic thoughts reframed into reality. It is painful to realize you are voting against the best interests of your own family. I empathaize with your discomfort. It took me a while to come to grips with mine as well.

You

ARE condoning the betterment of the wealthy at the expense of the working class. If you are against universal health care for all Americans, you

ARE for policies that harm the working class and enrich the already wealthy. If you are against Social Security which provides an income supplement for the elderly, who paid into it their entire working lives you

ARE condoning that the monied classes get richer at the expense of the labor force that created and expanded their wealth. If you are against Medicare which provides health care for the elderly, who paid into it their entire working lives, you are

ARE supporting the wealthy paying less than the working class. That my friend is the exact context and reality of your thought process.

At the minimum, the rich should pay the same, but there is nothing unfair about a progressive tax code. Without labor, capital is useless. There is no refuting that fact. The wealthy make massive returns on labor and the only fair way to to fund a just society is to charge more to those that benefit most. The wealthy will remain wealthy, and the working class will be more prosperous, and the middle class will be large and sustainable with the correctly balanced progressive tax system that focuses on infrastructure and the well-being of American citizens.

Get this through your head if you get nothing else - Capital without labor is usless and of no value. It takes the combination of both capital AND labor to form successful societies and economies. It is that simple. When you screw over labor by valuing capital more than labor is when situations like we are facing today occur.

Because you say that out of one side of your mouth then suggest with at straight face that the solution is to charge them a higher percentage of their income rather than an equal share. You see, I'm not off track; you're running on two separate tracks simultaneously.

Do you believe the wealthy will suffer some irreparable economic damage with a progressive system?

Here's a taxpayer with a $1,000,000 AGI that actually pays by the IRS schedule, married filing jointly:

Adjusted Gross Income - $1,000,000

Applied 2010 Tax Rates..

257,650

Net Income After Tax.... $742,346

That is less than 26% effective tax! Do you think you could survive reasonably well on $742,347 net income? I KNOW I could. This is ASSUMING these high earners actually report all of the $1,000,000 as earned income.

This is reality, however:

AGI.......................... $1,000,000

Capital Gains Tax.......

150,000

Net Income After Tax $850,000

Let's see how that compares to say the family income of a teacher and a nurse who had a pretty good year:

AGI.............................$137,050

Applied 2010 Tax Rates

26,638

Net Income After Tax.. $110,412

That is a little over a 24% effective tax rate.

Remember now, that the couple that earned the $1,000,000 AGI paid ZERO into Social Security after they reached an income of $106,800. That means $893,200 of their income was exempt from FICA.

Feel free to check my math Mr. School Teacher. I say that with all respect as I'm an adult vocational educator myself.

I'm cool with taxing capital gains the same as regular income. Lowering capital gains taxes was a great way to get people started investing for themselves. I don't think it would stop if Washington raised the rate. It would increase revenue fairly and prompt smaller investors to not put their emergency fund in the stock market.

More agreement.

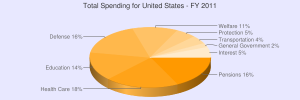

Sounds like we have some common ground. Not to take away from your point, but social spending outweighs military.

http://www.usgovernmentspending.com/us_budget_pie_chart

http://www.usgovernmentspending.com/us_budget_pie_chart

I came across this web site where you got your chart as I was researching CBO data. You might want to examine their agenda. Admittedly, each and every one of us has some agenda or other. My agenda is achieving a broad based middle class in a more egalitarian society. Here's the agenda of the creator of your pie chart:

I am a member of the international capitalist conspiracy. Both my grandfathers owned and operated import/export businesses in the early twentieth century, one in St. Petersburg, Russia, where my father was born, and the other in Kobe, Japan, where my mother was born.

I was born in India and raised and educated in England. I immigrated to the United States in 1968 and worked for many years designing and implementing utility control systems and software in Seattle.

Despite 35 years living in Seattle, I instinctively revolted against the suffocating left-coast culture of the Soviet of Washington, and came to revere the four great Germans who helped inspire the Reagan revolution: Ludwig von Mises, F.A. Hayek, Leo Strauss, and Eric Voegelin.

I have written for Liberty, FrontPageMag.com, and The American Thinker. My forthcoming book Road to the Middle Class celebrates the self-governing culture of the United States in which enthusiastic Christianity, education, mutual aid, and living under law have taught generations of immigrants to rise from indigence in the countryside to a life of competence and prosperity in the city.

At first glance, the guy is indeed impressive in his accomplishments. But a closer look reveals his true agenda. I understand that type of agenda from a guy who was raised by wealthy parents and married into wealth. He naturally supports government that will maximize his own wealth.

What I have trouble comprehending is how school teachers, nurses, managers, line workers, etc. would buy into that line of thinking that would clearly harm them economically.

At any rate, that chart is not accurate and does not even reflect the CBO data. See my post just before this one.

I think I mentioned in OTZ over a year ago that if we trimmed our defense spending by 50% we'd still be in the top 2-5 countries in military spending. I'd also eliminate federal education spending, pensions for Congress, and trim the hell out of the rest except infrastructure. Yeh, it would stimulate the hell out of the economy for people to get so much of their paycheck actually in their paycheck.

I could go with you except for cutting education. We neeed a better educated populous that understands how to separate political rhetoric from fact, and has a basic understanding of macro economics. I'd have no problem with congressional pensions if they actually recieved the same as rank-and-file federal workers. Our federal legislators get far better benefits than regular federal worker bees do, but they will throw the rank and file federal worker under the bus in a second while maintaining their benefits. They do this by getting working class folks like us to become envious of the middle class wages paid to federal workers and taking the focus off of the politicians and their wealthy PAC funders.

I'm reaching the forum character limit so I'll continue this discussion in the next post.