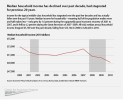

But not that rate of increase since 2008. And that is on your graph.

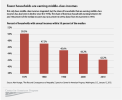

And this is why your associations are incorrect.

You directly compare the current financially distressed conditions of the government to economies without this extreme distress...... ignoring the disparity of ability to collect needed revenue. Your argument is a fallacy (

The Wikipedia graph clearly shows the association between declining revenues and increased debt load since 2008.